Happy Earth Day!

My gift to you this Earth Day is a “heads-up” about a something called “Clean Energy Victory Bonds (CEVB).”

Last week I tuned in to a webinar from Green America’s Green Business Network that explained them.

2 Representatives from California introduced a bill on April 8 in the House of Representatives to create “Clean Energy Victory Bonds.” The idea is based on the “Victory Bonds” that helped finance World War II.

I think it’s a great idea. Here’s why:

What is a CEVB?

- If passed, the bonds would be U.S. Treasury bonds of the EE type. They will specifically finance the production of clean energy technologies.

- The interest will be competitive with other EE bonds.

- The sectors supported include solar, wind, geothermal, biofuels, electric vehicles and energy efficiency technologies.

- The face amounts would be as little as $25, so small investors can participate. And redemption periods are very flexible, ranging from 12 months to 30 years.

- The plan is to sell $50 billion in bonds, with the expectation that that would attract additional public and private investment on the order of $150 billion more.

Why are they needed?

- The bonds bypass Congress. The US is losing the renewables race to countries like Germany and China. Bonds take the issue of financing clean energy away from our dithering Congress and put it into the hands of both citizens and investors.

- The bonds would provide a steady and consistent source of financing. For businesses that never know if a particular government tax credit will be there or not, this form of financing guarantees consistency over the longer term.

- These bonds enable investors of all sizes to participate. There is plenty of interest and support for this bill. Over 15,000 people coast to coast have already pledged to buy the bonds. And the bill was just proposed.

What will CEVBs do for our economy?

- Create jobs. It is expected that the funding from CEVBs would create over a million jobs. Not just jobs in the future, but jobs right now in areas like construction and manufacturing. This is more jobs than the fossil-fuel sector creates. And the jobs, on average, pay more.

- Avoid new taxes. This is not a tax. CEVBs would be an investment option, and people who want to own part of the clean energy future can buy in.

- Improve energy security. As renewable energy options are deployed, the U.S.’s reliance on unstable countries for oil will diminish. And unpleasant oil price shocks will be a thing of the past.

What will they do for the environment?

CEVBs will support both research into and deployment of technologies to:

- Reduce greenhouse gas emissions

- Reduce the air and water pollution that result from fossil fuel drilling, mining and burning

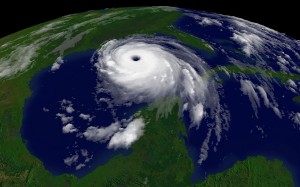

- Reduce the likelihood of catastrophic natural disasters (floods, fires, storms) that have become more frequent and more severe as the planet warms.

How can you get involved?

- Pledge to buy a bond! Great Green Content has already pledged to support this bill and to buy bonds.

- Tell your Representative in Washington that you support this bill. The more sponsors, the better its chances for passage.

Required caveat: I am not an investment adviser. So use your common sense when it comes to this, or any other, financial decision.